Photographer: Nicolas Tucat/AFP via Getty Images

Photographer: Nicolas Tucat/AFP via Getty Images

JPMorgan Chase & Co. traders are said to be “salivating” over Bitcoin. It’s easy to see why. The cryptocurrency’s price has shot past $50,000, double where it was on Christmas Day, creating a powerful centrifugal force of excitement — and real money judging by crypto exchange Coinbase Inc.’s reported profit margins of 20%.

Never mind that Bitcoin’s persistent flaws, from relatively slow transaction speeds to wild price swings, make it a poor store of value or medium of exchange. The promise of life-changing wealth during lockdown is a strong draw for eager punters. Beyond the memes, wealthy financiers and billionaires are loudly loading up on digital gold, drowning out any skeptical voices. Elon Musk’s Tesla Inc. has plowed $1.5 billion into Bitcoin, and wealthy hedge-funders like Paul Tudor Jones and Stanley Druckenmiller are on board.

It’s hard to heed “boomer” warnings comparing the craze to 17th-century Dutch tulip mania when the likes of ARK Investment Management’s Cathie Wood are egging firms on to buy.

No wonder the world of “legacy” corporate finance is salivating. The mood echoes how Citigroup Inc.’s former boss Chuck Prince depicted the peak of the subprime bubble: “As long as the music is playing, you’ve got to get up and dance.” Nowadays it seems everyone is adding crypto to their dance card.

MasterCard Inc. and Bank of New York Mellon Corp. have announced crypto plans, while JPMorgan Co-President Daniel Pinto says his bank will “get involved” eventually. Some investors say they’ve bought crypto while hating every minute of it — the very definition of the Fear of Missing Out.

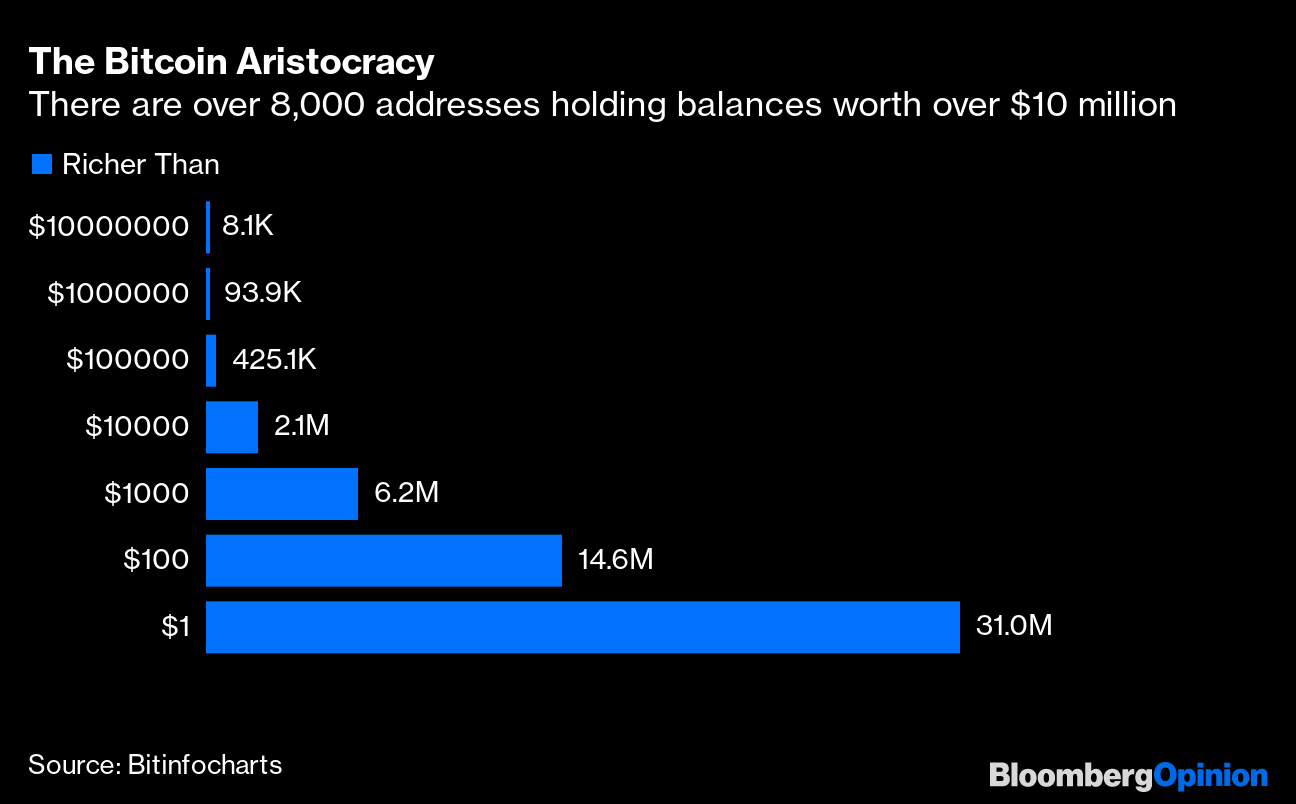

The Bitcoin Aristocracy

There are over 8,000 addresses holding balances worth over $10 million

Source: Bitinfocharts

Hard as it is to resist crypto FOMO, it’s still worth thinking about rules of engagement and taking a careful approach. One principle might be to remind companies of their fiduciary duty to shareholders. Simply sticking Bitcoin on the balance sheet like Tesla is a poor hedge, as its price tumbles in times of market stress have shown. It’s not a common medium of exchange either, with merchants amounting to an estimated 1% of crypto transactions between mid-2019 and mid-2020.

Most companies with a dollar cost base selling goods other than luxury cars have no real need to hold a pile of cryptocurrencies. Copying Musk is for the brave — it only works if the price keeps going up. Corporations should stick to their financial lane, not swerve onto Tesla’s. Most investors prefer for excess cash to be reinvested in operations, returned or managed appropriately.

For bankers, acting as a broker for crypto clients could certainly fit into their job description. However, some caution is warranted here, too. Jean Dermine, a professor of banking at Insead, reckons Bitcoin touches on several areas of risk: operational risk, such as client identification and the potential for fraud; legal, especially with a decentralized global asset; and regulatory risk, given a history of lawsuits and government crackdowns in the sector. And then there’s the need to protect consumers too.

So while trading Bitcoin might make business sense, the risks should make it expensive to do so, with high levels of loss-absorbing capital set aside to back it. Switzerland, for example, has reportedly guided toward a flat bank risk weight of 800% for Bitcoin. That helps explain why banks have so far kept one step removed from the asset, whether via futures or taking on crypto exchanges as clients.

While treading cautiously on Bitcoin, banks would do well to take a more strategic approach to the whole crypto landscape. The future of money hasn’t been decided yet, and “legacy” finance may be better equipped to co-opt or compete against such assets than people think. Banks have been toiling away at proprietary blockchain projects, such as JPMorgan’s JPM Coin, which could save money on payments. They are natural partners for central banks’ planned digital currencies, like the digital euro.

Finally, a principle for regulators. They should take a balanced approach to financial innovation without letting systemic risks get out of hand. Crypto exchanges are better regulated than they used to be, and consumer warnings are issued frequently. But if Bitcoin became deeply embedded in the global financial system, the question would inevitably arise over what to do if an asset with no government backer crashed.

When the music stopped for Citi and others in the 2007-2008 financial crisis, central banks joined hands to throw the financial system multiple lifelines — helping spur the creation of Bitcoin itself. It would be a very odd look for the Bitcoin aristocracy to be bailed out by its arch-nemesis, central bank fiat money.

Bitcoin is playing an irresistible tune, but for many in the corporate-finance world, the best dance right now should be baby steps.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Melissa Pozsgay at [email protected]