Turkey’s lira has kicked off 2021 as the world’s leading emerging market currency, drawing a stark contrast to its dour performance last year.

The currency has rallied around 6.5 per cent against the dollar since the end of 2020, far exceeding the 1.8 per cent gain for Ukraine’s hryvnia, the second-best performing major EM currency this year.

The rebound, which has brought the exchange rate against the dollar just below the closely watched TL7 level, highlights the sharp shift in investor sentiment that came after Turkey shook up its economic management in November. The currency plunged by a fifth last year, trading weaker than 8.5 lira to the dollar for the first time.

President Recep Tayyip Erdogan’s decisions to let his son-in-law Berat Albayrak quit as finance minister, and to install a central bank chief with the leeway to deploy more orthodox monetary policies than his predecessor, have been credited with the brightening outlook.

The central bank, led by Naci Agbal, on Thursday held the country’s main policy rate at 17 per cent, having lifted it by 6.75 percentage points in a bid to stomp out rapid inflation that had caused foreign investors to flee last year and Turkish citizens to convert their cash into foreign currencies such as dollars.

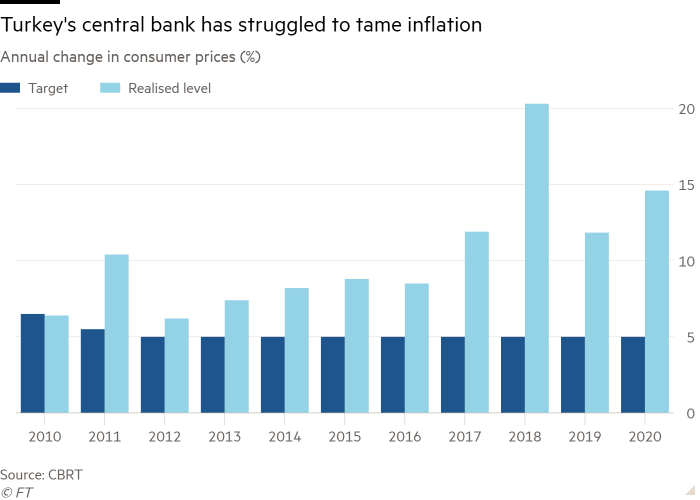

Agbal’s predecessors had, in contrast, kept rates low even as inflation surged, reflecting Erdogan’s preference for credit-fuelled growth.

The new central bank chief’s “statements and his actions have underscored the priority is to improve inflation in the medium term, and this has rebuilt the bank’s credibility, making the lira more attractive to foreign investors”, said Enver Erkan, an economist at Tera Securities in Istanbul.

Inflation continues to accelerate in Turkey, where consumer prices rose 15 per cent in January compared with the same month in 2020: well above the central bank’s official 5 per cent target.

But interest rates are 2 percentage points higher still, providing investors with inflation-adjusted yields that rank among the highest in emerging markets at a time when returns on developed market debt are near historic lows.

Inflation is expected to slow after a peak in April, which may allow the bank to begin reducing interest rates; but it is expected to do so slowly and in line with disinflation, Erkan said. The lira’s rally may weaken when the central bank starts to sell lira to rebuild its foreign-currency reserves, which the previous governor had depleted in a fruitless attempt to halt the lira’s decline.

The central bank chief could face pressure from the president, who has long railed against high inflation rates, to reduce borrowing costs, but at present Turkey is “taking the bitter medicine of a high interest-rate policy”, Erkan said. “Economic growth has taken a back seat to inflation,” he added.

The central bank cannot do all the work on its own, said Piotr Matys, a strategist at Rabobank. “I think investors may start paying more attention [to] whether there is genuine progress on economic reforms. So far we’ve mainly heard encouraging comments . . . but we haven’t seen anything concrete,” Matys said.

Additional reporting by Laura Pitel in Ankara